Caesars Entertainment Corporation - All Bets Are Off

Sep 17 2013, 07:50

| about: CZR

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. AlphaStreetResearch is a team of Investment Research Analysts. This article was written by Mr. Hunter Orr, Director of Research, with research assistance from Mr. Aaron Zander, Junior Research Analyst.

Caesars Entertainment Corporation (CZR) is a highly overvalued gaming, hotel, and entertainment company with deteriorating fundamentals on all levels in a highly competitive environment. The company's stock has seen a massive run to the upside on the coattails of other casino and entertainment companies in the space. A considerable catalyst for the push higher in these stocks is the good news coming out of Macau, but this is an area where Caesars has absolutely no exposure and will be locked out of for the foreseeable future after failing to take appropriate licensing measures. Below is our introduction into the business model, its weaknesses, and the new selling or shorting opportunity that exists for CZR after the recent appreciation in share price. Investors will soon realize that there is little upside value in this company and that there are much better opportunities in this space. The company is now amidst a major struggle from a debt standpoint with major deadlines approaching over the next year and a half. The company is in no position to thrive going forward unless major steps are taken to overhaul the company's capital structure.

Caesars Entertainment has a market cap of $3.19 Billion after the stock has moved up over 225% year to date and reports its next quarter on October 31, 2013. With this in mind, we value CZR at $21.00 by year-end of 2013 and $14.00 by August 1, 2014, a decrease of 40% from current levels.

We will later highlight:

1) Better understanding the CZR business model

2) The failed opportunities and investments for CZR in Macau

3) The most recent quarter and troubling facts

4) The economics of the CZR business and company overview

5) Future struggles, consumer trends, and debt burden

6) Cash/Valuation to peers

Caesars Entertainment in Layman's Terms

Caesars Entertainment Corporation owns, operates, or manages casino entertainment facilities. The casino facilities include land-based casinos, riverboat casinos, and managed casinos, as well as casinos combined with a greyhound racetrack or thoroughbred racetrack. The company operates its casinos primarily under the Caesars, Harrahs, and Horseshoe names. It also operates hotel and convention space, restaurants, and non-gaming entertainment facilities. In addition, the company owns and operates an online gaming business that provides real money casino, bingo, and poker games under the WSOP and Caesars brands. Caesars owns and operates the World Series of Poker tournament and brand. Overall, Caesars owns, operates, or manages 52 casinos in 7 countries, as well as in the 13 states of the United States. The company was formerly known as Harrahs Entertainment and changed its name to Caesars Entertainment Corporation in November 2010.

(Click to enlarge)

Disappointment on the Macau Front - A Missed Opportunity for the Future

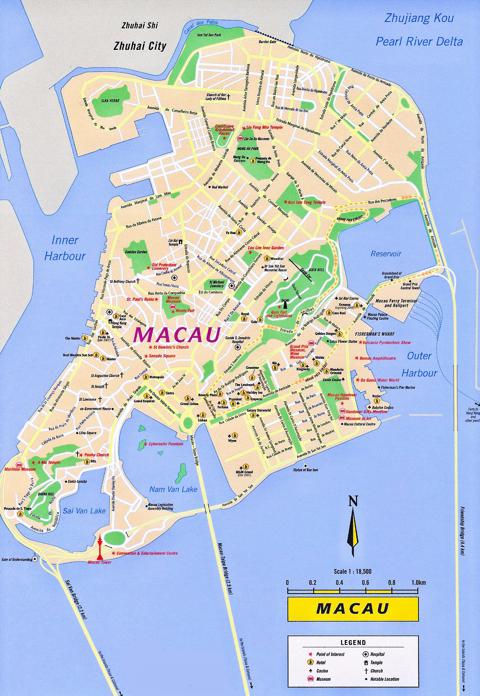

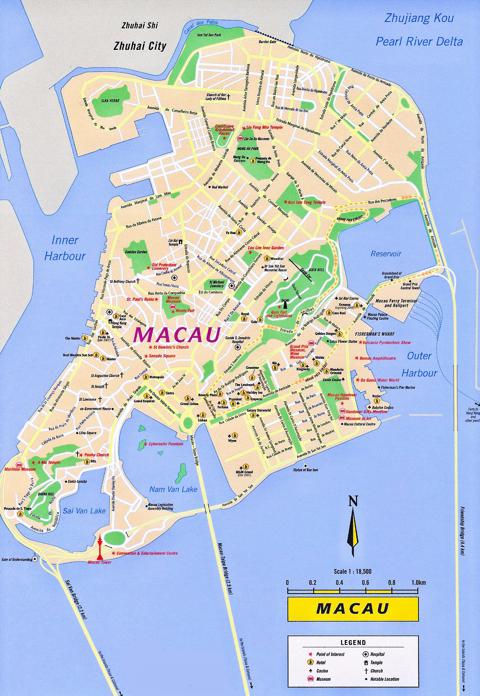

Caesar's Entertainment announced earlier this year that the company is selling its property in Macau to an Asian developer for $438 million. This essentially marks the end for Caesar's failed attempt to move into the thriving Macau gambling scene.

The sale is expected to close by the end of the year, and the company intends to use the proceeds to pay down debt. The stock has traded significantly higher since the announcement of the deal, but we believe that this is a huge missed opportunity for the company in a new, booming market and will hurt the company over the long-term as competition continues to expand in this area. Caesars is the largest casino operator in the U.S., with properties in Las Vegas, Atlantic City, N.J., Indiana, Louisiana, Mississippi and several other states, but is the only major U.S. casino company without a casino in Macau. Caesars bought the 175-acre site in 2007 for $578 million, with plans to develop a hotel and casino, but the company did not apply in the early 2000s for one of the limited number of gambling licenses in Macau, and it never gained a gambling concession from the Macau government.

As of July 31, 2013, growth in Macau has increased to over 20% on a year over year basis boosted by an increase in the number of Chinese visitors to the country's only legal casino gambling hub. July's 29.5 billion patacas ($3.7 billion) revenue was the third strongest figure this year, according to government data, as more middle-class gamblers visited Macau, eclipsing the growth in the number of high rollers. The slowdown in China's economic growth has kept away some wealthy customers, who often spend 1 million yuan ($160,000) per bet, but it failed to push away Macau's appeal for China's rapidly expanding middle-class and their higher disposable incomes.

The number of visitors to Macau rose 4.2 percent during the first half of the year. Visitors from mainland China, who account for two thirds of the total numbers, soared 20 percent in July year over year numbers. High rollers account for about 70 percent of gaming revenues, but the share of middle-class gamblers is growing at a much faster rate and Macau's casinos are trying to diversify entertainment options to attract more of these visitors. Gamblers are also betting more due to higher table limits in the main casinos. Minimum table bets start at around 300 patacas ($38) compared to a year ago when customers could easily find tables offering bets for 100-200 patacas ($20). In the end, investors should not have seen the sale of this property as a catalyst for the stock, but instead as the huge missed opportunity to diversify the company's core business and expand into an explosive new market.

(Click to enlarge)

Recent channel checks in Macau casinos and hotels show strong September gaming revenue. At the current rate, gambling revenue for the month of September so far is tracking 25.7% higher than the same month a year ago. Macau generates annual gambling revenue topping $38 billion, larger than any other casino district in the world, about five times the annual take of U.S. gambling in Las Vegas. Macau, a special gaming district on China's southern coast and the only place in China where casino gambling is legal, is looking to expand to nearby islands. Obviously this is an area where Caesars will not be participating. We believe that the run up in CZR shares has been on the coattails of the other gaming and hotel companies and that the buying has been way overdone. Investors should look for the stock to pull back substantially after the recent rally.

Another disappointment for the company internationally recently came when the government ministries in South Korea declined the company's application for pre-approval to develop an integrated resort in Incheon. The company has a 90-day period to appeal the decision, but the outlook is bleak.

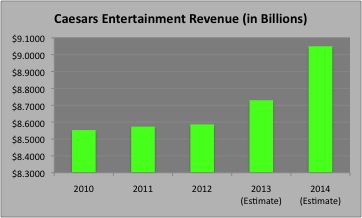

The Most Recent Quarter - Focusing on the Important Aspects of This Business

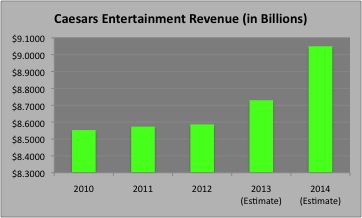

Caesars reported second quarter net revenue of $2.2 billion, which was relatively flat year-over-year, as a decline in casino revenue was largely offset by increases in F&B, rooms, and managed revenue. The company attributes this decline to a combination of macroeconomic conditions, competition, and a shift in marketing strategy. The company has lost market share in gaming to competition, despite the company's positioning with the World Series of Poker brand. Revenue and profit estimates for the rest of 2013 and 2014 are high based on the current trends for this year and guidance for next calendar year, and investors should be cautious of disappointing earnings coming out of the company going forward. We believe that revenues and profits have peaked and that CZR will face many headwinds over the next 12 months.

Income from operations totaled $125.3 million, down $63.8 million compared to the prior year. The 33.7% decline was primarily driven by higher asset impairment charges. Adjusted EBITDA declined 8.2% to $470.5 million and Property EBITDA declined 4.9% to $492.8 million compared with the year-earlier period. The major area of concern that investors should focus on is the lower gaming revenue.

Taking a look at performance in Las Vegas, the second quarter net revenue decreased 4.5% year-over-year to $745.9 million, due to lower casino revenue and development and construction activities. Casino revenue in Las Vegas declined approximately 15.5% year-over-year, primarily due to loss of market share and visitors and weaker gaming volumes.

When looking at the Atlantic City region, the same trends are occurring. Net revenue declined by 8.3% year-over-year to $400.1 million, as gaming revenue was down due to lower visitation driven primarily by new competitive threats. Atlantic City's property EBITDA during the quarter was down 5.9% year-over-year to $61.3 million. This decrease was driven by the impact of the revenue decline. Overall market volume declined in Atlantic City and CZR market share has declined.

Looking at other regional markets, which include properties outside of Las Vegas and Atlantic City, revenue declined 1.1% year-over-year to $748.1 million. Casino revenue was lower across the company's regional network, driven by lower visitation rates. The company continues to face increased competition in certain areas like Louisiana/Mississippi, particularly in Tunica. These overall trends will continue as competition in Las Vegas and Atlantic City increase. The company's investments in current properties and new construction may prove to be too little, too late, as the projects have become increasingly costly over the last two years.

The Debt Burden

The total face value of debt for CZR was $23.7 billion at quarter-end. Debt, net of $1.8 billion of cash, was $20.9 billion. Total debt repurchased during the last quarter was only around $275 million. Reports of a possible Caesars bankruptcy have been heating up since April when Moody's downgraded the company's credit rating to one of its lowest levels. Cash flow growth has not expanded for Caesars in 2013 as a result of a demand drop fueled by customers spending less at casinos. When looking at the casino revenues from the most recent quarter, this is a major concern going forward as competitors gaming revenues continue to thrive. The company has consistently poured money into new construction and the remodeling of existing structures, but significant measures need to be taken in order to improve the company's current capital structure. If the company cannot spur major cash flow generation over the course of the next year, the company will be facing some major problems in early 2015. A key date occurs in January 2015 when $4.4 billion of mortgage-backed securities are scheduled to mature for CZR. In the company's most recent earnings report in July, Caesars noted that it had only bought back $275 million in debt and that its financial strategy included beefing up its product offerings in Las Vegas and entering the Maryland casino market, breaking ground on a property in Baltimore.

Major Areas of Concern for the Future

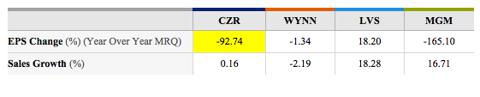

Annual Growth

(Click to enlarge)

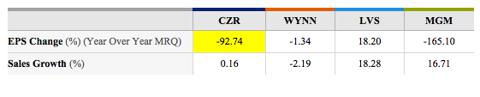

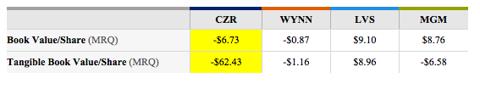

One of the largest concerns for CZR the significant decline in EPS and Sales Growth over the recent history and the high rate at which it is occurring. Considering the country has been seeing an economic recovery, consumer spending on gaming and entertainment in Las Vegas has not kept up. With no exposure to Macau, CZR will continue to underperform its peers in the future. The company's current strategy is failing domestically and trying to transition to anything internationally is impossible. The EPS Change of -92.74% and 0.16% Sales Growth is just the beginning of a negative trend for Caesars. With massive amounts of debt and important maturity dates approaching, investors should look for a significant decline in shares as nervousness continues to build.

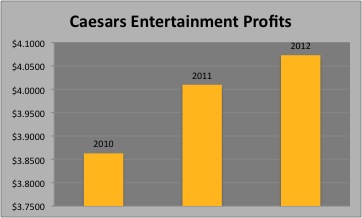

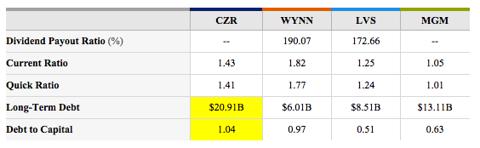

Profitability

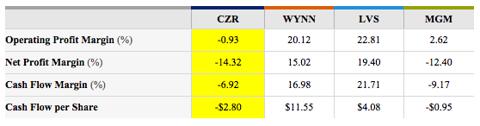

(Click to enlarge)

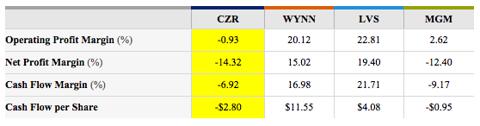

To determine CZR earnings quality, investors can look at cash flow and margins. The quality of the most recent CZR earnings quarter was very poor overall. The company is bearing a negative cash flow per share. This is not a good situation for the company to be in for a long time, because it is borrowing a significant amount of money to keep operating. At some point, the banks will stop lending and want to be repaid. The negative cash flow also indicates that there is a fundamental operating problem. "Cash is king" on Wall Street, and companies that don't generate cash are not around for long. Caesars will begin to struggle going forward and is stuck in a position that requires a lot of cash to improve. Unfortunately, time is running out, as major debt obligations are due in early 2015. The chart below shows CZR's declining cash flows and if the current trend continues, the company will be generating almost no cash by the end of 2013.

Per Share Data

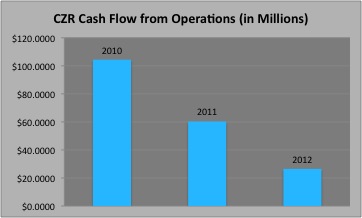

(Click to enlarge)

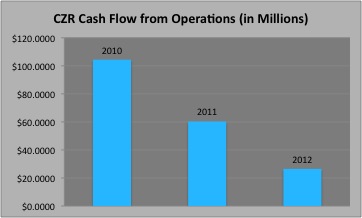

It is important for investors to pay attention to the Book Value/Share of CZR. As the "B" word has been thrown around recently (Bankruptcy), this is a key metric for investors to focus on because should the company decide to dissolve, the book value per common indicates the dollar value remaining for common shareholders after all assets are liquidated and all debtors are paid.

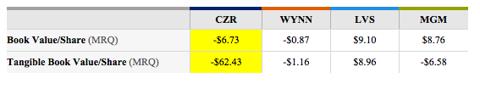

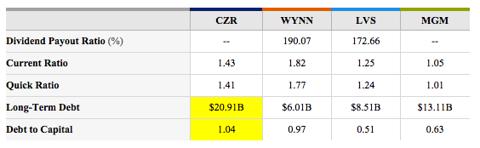

Financial Strength

(Click to enlarge)

The use of leverage can be a double-edged sword for companies. In the case for CZR, it has tried to generate returns above its cost of capital, for investors benefit. However, with the added risk of the debt on its books, CZR is a company that has been hurt by this leverage and is unable to generate returns above the cost of capital. The company's losses have been and will continue to be magnified by the use of leverage in the company's capital structure, while they continue to renovate existing properties and continue with new construction domestically. With $20.91B of long-term debt and a large debt to equity ratio of 1.04, Caesars will need to significantly overhaul their capital structure if they want to compete and survive in this highly competitive industry.

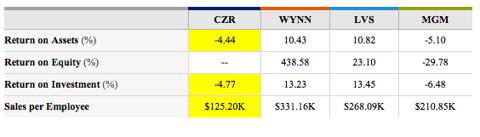

Management Effectiveness

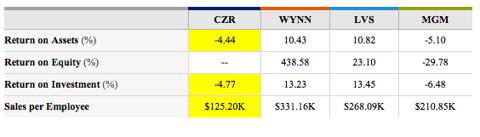

(Click to enlarge)

Obviously when looking at these measures, CZR is failing on all fronts. Caesars Sales per Employee is the lowest in the industry, and we would expect to see the company make some changes going forward in order to cut costs if it wanted to avoid bankruptcy in the future. When specifically focusing on the ROA of -4.44%, the company is failing when it comes to the operating efficiency based on the firm's generated profits from total assets. The ROI of -4.77% shows the firm's failing efficiency in utilizing invested capital. These are not the numbers investors want to see for a supposed "thriving business" in an economic recovery and the trends look even worse for the future.

(Click to enlarge)

What Investors Need to Know

Caesars Entertainment is a company with a large battle on its hands. So far this year, the stock has significantly outperformed the market, up over 225%, with short covering contributing a great deal of support. Currently there is still a 26.90% short percent of the float, and bears are expecting investors to be spooked potentially by the next earnings release on October 31, 2013. The company will have many questions to answer regarding the slowing business in the U.S., failure to expand international operations, and how it is going to handle the major debt burden.

In the end, Caesars Entertainment is a highly overvalued company with deteriorating fundamentals and a huge debt burden. Only time will tell if the company's investments domestically will pay off, but we know for sure that expanding operations internationally will not happen. Caesars also needs to see increased consumer traffic and spending for future prospects to improve. The stock has run too far, too fast without any significant catalysts and we expect shares to retreat the rest of the year. We presented the struggling business model, the weaknesses, and the new selling or shorting opportunity that exists for CZR. With this in mind, we value CZR at $21.00 by year-end of 2013 and $15.00 by August 1, 2014, a decrease of 40% from current levels. We arrive at the $14.00 estimate by applying the best of breed multiple in this sector of 28 to $0.50 in earnings per share (way above even best case estimates), so as we can see, even best case scenario numbers cannot justify a share price above $14.00.

http://seekingalpha.com/article/1697862-caesars-entertainment-corporation-all-bets-are-off?source=google_news

Caesars Entertainment Corporation (CZR) is a highly overvalued gaming, hotel, and entertainment company with deteriorating fundamentals on all levels in a highly competitive environment. The company's stock has seen a massive run to the upside on the coattails of other casino and entertainment companies in the space. A considerable catalyst for the push higher in these stocks is the good news coming out of Macau, but this is an area where Caesars has absolutely no exposure and will be locked out of for the foreseeable future after failing to take appropriate licensing measures. Below is our introduction into the business model, its weaknesses, and the new selling or shorting opportunity that exists for CZR after the recent appreciation in share price. Investors will soon realize that there is little upside value in this company and that there are much better opportunities in this space. The company is now amidst a major struggle from a debt standpoint with major deadlines approaching over the next year and a half. The company is in no position to thrive going forward unless major steps are taken to overhaul the company's capital structure.

Caesars Entertainment has a market cap of $3.19 Billion after the stock has moved up over 225% year to date and reports its next quarter on October 31, 2013. With this in mind, we value CZR at $21.00 by year-end of 2013 and $14.00 by August 1, 2014, a decrease of 40% from current levels.

We will later highlight:

1) Better understanding the CZR business model

2) The failed opportunities and investments for CZR in Macau

3) The most recent quarter and troubling facts

4) The economics of the CZR business and company overview

5) Future struggles, consumer trends, and debt burden

6) Cash/Valuation to peers

Caesars Entertainment in Layman's Terms

Caesars Entertainment Corporation owns, operates, or manages casino entertainment facilities. The casino facilities include land-based casinos, riverboat casinos, and managed casinos, as well as casinos combined with a greyhound racetrack or thoroughbred racetrack. The company operates its casinos primarily under the Caesars, Harrahs, and Horseshoe names. It also operates hotel and convention space, restaurants, and non-gaming entertainment facilities. In addition, the company owns and operates an online gaming business that provides real money casino, bingo, and poker games under the WSOP and Caesars brands. Caesars owns and operates the World Series of Poker tournament and brand. Overall, Caesars owns, operates, or manages 52 casinos in 7 countries, as well as in the 13 states of the United States. The company was formerly known as Harrahs Entertainment and changed its name to Caesars Entertainment Corporation in November 2010.

(Click to enlarge)

Disappointment on the Macau Front - A Missed Opportunity for the Future

Caesar's Entertainment announced earlier this year that the company is selling its property in Macau to an Asian developer for $438 million. This essentially marks the end for Caesar's failed attempt to move into the thriving Macau gambling scene.

The sale is expected to close by the end of the year, and the company intends to use the proceeds to pay down debt. The stock has traded significantly higher since the announcement of the deal, but we believe that this is a huge missed opportunity for the company in a new, booming market and will hurt the company over the long-term as competition continues to expand in this area. Caesars is the largest casino operator in the U.S., with properties in Las Vegas, Atlantic City, N.J., Indiana, Louisiana, Mississippi and several other states, but is the only major U.S. casino company without a casino in Macau. Caesars bought the 175-acre site in 2007 for $578 million, with plans to develop a hotel and casino, but the company did not apply in the early 2000s for one of the limited number of gambling licenses in Macau, and it never gained a gambling concession from the Macau government.

As of July 31, 2013, growth in Macau has increased to over 20% on a year over year basis boosted by an increase in the number of Chinese visitors to the country's only legal casino gambling hub. July's 29.5 billion patacas ($3.7 billion) revenue was the third strongest figure this year, according to government data, as more middle-class gamblers visited Macau, eclipsing the growth in the number of high rollers. The slowdown in China's economic growth has kept away some wealthy customers, who often spend 1 million yuan ($160,000) per bet, but it failed to push away Macau's appeal for China's rapidly expanding middle-class and their higher disposable incomes.

The number of visitors to Macau rose 4.2 percent during the first half of the year. Visitors from mainland China, who account for two thirds of the total numbers, soared 20 percent in July year over year numbers. High rollers account for about 70 percent of gaming revenues, but the share of middle-class gamblers is growing at a much faster rate and Macau's casinos are trying to diversify entertainment options to attract more of these visitors. Gamblers are also betting more due to higher table limits in the main casinos. Minimum table bets start at around 300 patacas ($38) compared to a year ago when customers could easily find tables offering bets for 100-200 patacas ($20). In the end, investors should not have seen the sale of this property as a catalyst for the stock, but instead as the huge missed opportunity to diversify the company's core business and expand into an explosive new market.

(Click to enlarge)

Recent channel checks in Macau casinos and hotels show strong September gaming revenue. At the current rate, gambling revenue for the month of September so far is tracking 25.7% higher than the same month a year ago. Macau generates annual gambling revenue topping $38 billion, larger than any other casino district in the world, about five times the annual take of U.S. gambling in Las Vegas. Macau, a special gaming district on China's southern coast and the only place in China where casino gambling is legal, is looking to expand to nearby islands. Obviously this is an area where Caesars will not be participating. We believe that the run up in CZR shares has been on the coattails of the other gaming and hotel companies and that the buying has been way overdone. Investors should look for the stock to pull back substantially after the recent rally.

Another disappointment for the company internationally recently came when the government ministries in South Korea declined the company's application for pre-approval to develop an integrated resort in Incheon. The company has a 90-day period to appeal the decision, but the outlook is bleak.

The Most Recent Quarter - Focusing on the Important Aspects of This Business

Caesars reported second quarter net revenue of $2.2 billion, which was relatively flat year-over-year, as a decline in casino revenue was largely offset by increases in F&B, rooms, and managed revenue. The company attributes this decline to a combination of macroeconomic conditions, competition, and a shift in marketing strategy. The company has lost market share in gaming to competition, despite the company's positioning with the World Series of Poker brand. Revenue and profit estimates for the rest of 2013 and 2014 are high based on the current trends for this year and guidance for next calendar year, and investors should be cautious of disappointing earnings coming out of the company going forward. We believe that revenues and profits have peaked and that CZR will face many headwinds over the next 12 months.

Income from operations totaled $125.3 million, down $63.8 million compared to the prior year. The 33.7% decline was primarily driven by higher asset impairment charges. Adjusted EBITDA declined 8.2% to $470.5 million and Property EBITDA declined 4.9% to $492.8 million compared with the year-earlier period. The major area of concern that investors should focus on is the lower gaming revenue.

Taking a look at performance in Las Vegas, the second quarter net revenue decreased 4.5% year-over-year to $745.9 million, due to lower casino revenue and development and construction activities. Casino revenue in Las Vegas declined approximately 15.5% year-over-year, primarily due to loss of market share and visitors and weaker gaming volumes.

When looking at the Atlantic City region, the same trends are occurring. Net revenue declined by 8.3% year-over-year to $400.1 million, as gaming revenue was down due to lower visitation driven primarily by new competitive threats. Atlantic City's property EBITDA during the quarter was down 5.9% year-over-year to $61.3 million. This decrease was driven by the impact of the revenue decline. Overall market volume declined in Atlantic City and CZR market share has declined.

Looking at other regional markets, which include properties outside of Las Vegas and Atlantic City, revenue declined 1.1% year-over-year to $748.1 million. Casino revenue was lower across the company's regional network, driven by lower visitation rates. The company continues to face increased competition in certain areas like Louisiana/Mississippi, particularly in Tunica. These overall trends will continue as competition in Las Vegas and Atlantic City increase. The company's investments in current properties and new construction may prove to be too little, too late, as the projects have become increasingly costly over the last two years.

The Debt Burden

The total face value of debt for CZR was $23.7 billion at quarter-end. Debt, net of $1.8 billion of cash, was $20.9 billion. Total debt repurchased during the last quarter was only around $275 million. Reports of a possible Caesars bankruptcy have been heating up since April when Moody's downgraded the company's credit rating to one of its lowest levels. Cash flow growth has not expanded for Caesars in 2013 as a result of a demand drop fueled by customers spending less at casinos. When looking at the casino revenues from the most recent quarter, this is a major concern going forward as competitors gaming revenues continue to thrive. The company has consistently poured money into new construction and the remodeling of existing structures, but significant measures need to be taken in order to improve the company's current capital structure. If the company cannot spur major cash flow generation over the course of the next year, the company will be facing some major problems in early 2015. A key date occurs in January 2015 when $4.4 billion of mortgage-backed securities are scheduled to mature for CZR. In the company's most recent earnings report in July, Caesars noted that it had only bought back $275 million in debt and that its financial strategy included beefing up its product offerings in Las Vegas and entering the Maryland casino market, breaking ground on a property in Baltimore.

Major Areas of Concern for the Future

- No unique value proposition built on approach, scale, geographic reach, brands, and loyalty

- Not positioned to drive value creation and significant revenue upside

- Huge investments made in trying to expand core of business - declining revenues in many areas of business will lead to serious problems if the capital structure is not re-vamped by 2015

- Not executing on development pipeline, expanding domestic distribution and social/mobile gaming platform - the company claims that social gaming has a bright future, but the uncertain regulatory conditions on a state and federal level pose a serious threat to the future of this revenue source

- Failure to capitalize on pipeline while competitors continue to thrive on an international level (failure in Macau and Korea are significant)

- Failed focus on managing costs and improving capital structure

- Sustained economic recovery has not provided an additional tailwind to the efforts of the company

Annual Growth

(Click to enlarge)

One of the largest concerns for CZR the significant decline in EPS and Sales Growth over the recent history and the high rate at which it is occurring. Considering the country has been seeing an economic recovery, consumer spending on gaming and entertainment in Las Vegas has not kept up. With no exposure to Macau, CZR will continue to underperform its peers in the future. The company's current strategy is failing domestically and trying to transition to anything internationally is impossible. The EPS Change of -92.74% and 0.16% Sales Growth is just the beginning of a negative trend for Caesars. With massive amounts of debt and important maturity dates approaching, investors should look for a significant decline in shares as nervousness continues to build.

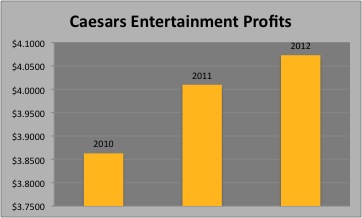

Profitability

(Click to enlarge)

To determine CZR earnings quality, investors can look at cash flow and margins. The quality of the most recent CZR earnings quarter was very poor overall. The company is bearing a negative cash flow per share. This is not a good situation for the company to be in for a long time, because it is borrowing a significant amount of money to keep operating. At some point, the banks will stop lending and want to be repaid. The negative cash flow also indicates that there is a fundamental operating problem. "Cash is king" on Wall Street, and companies that don't generate cash are not around for long. Caesars will begin to struggle going forward and is stuck in a position that requires a lot of cash to improve. Unfortunately, time is running out, as major debt obligations are due in early 2015. The chart below shows CZR's declining cash flows and if the current trend continues, the company will be generating almost no cash by the end of 2013.

Per Share Data

(Click to enlarge)

It is important for investors to pay attention to the Book Value/Share of CZR. As the "B" word has been thrown around recently (Bankruptcy), this is a key metric for investors to focus on because should the company decide to dissolve, the book value per common indicates the dollar value remaining for common shareholders after all assets are liquidated and all debtors are paid.

Financial Strength

(Click to enlarge)

The use of leverage can be a double-edged sword for companies. In the case for CZR, it has tried to generate returns above its cost of capital, for investors benefit. However, with the added risk of the debt on its books, CZR is a company that has been hurt by this leverage and is unable to generate returns above the cost of capital. The company's losses have been and will continue to be magnified by the use of leverage in the company's capital structure, while they continue to renovate existing properties and continue with new construction domestically. With $20.91B of long-term debt and a large debt to equity ratio of 1.04, Caesars will need to significantly overhaul their capital structure if they want to compete and survive in this highly competitive industry.

Management Effectiveness

(Click to enlarge)

Obviously when looking at these measures, CZR is failing on all fronts. Caesars Sales per Employee is the lowest in the industry, and we would expect to see the company make some changes going forward in order to cut costs if it wanted to avoid bankruptcy in the future. When specifically focusing on the ROA of -4.44%, the company is failing when it comes to the operating efficiency based on the firm's generated profits from total assets. The ROI of -4.77% shows the firm's failing efficiency in utilizing invested capital. These are not the numbers investors want to see for a supposed "thriving business" in an economic recovery and the trends look even worse for the future.

(Click to enlarge)

What Investors Need to Know

Caesars Entertainment is a company with a large battle on its hands. So far this year, the stock has significantly outperformed the market, up over 225%, with short covering contributing a great deal of support. Currently there is still a 26.90% short percent of the float, and bears are expecting investors to be spooked potentially by the next earnings release on October 31, 2013. The company will have many questions to answer regarding the slowing business in the U.S., failure to expand international operations, and how it is going to handle the major debt burden.

In the end, Caesars Entertainment is a highly overvalued company with deteriorating fundamentals and a huge debt burden. Only time will tell if the company's investments domestically will pay off, but we know for sure that expanding operations internationally will not happen. Caesars also needs to see increased consumer traffic and spending for future prospects to improve. The stock has run too far, too fast without any significant catalysts and we expect shares to retreat the rest of the year. We presented the struggling business model, the weaknesses, and the new selling or shorting opportunity that exists for CZR. With this in mind, we value CZR at $21.00 by year-end of 2013 and $15.00 by August 1, 2014, a decrease of 40% from current levels. We arrive at the $14.00 estimate by applying the best of breed multiple in this sector of 28 to $0.50 in earnings per share (way above even best case estimates), so as we can see, even best case scenario numbers cannot justify a share price above $14.00.

http://seekingalpha.com/article/1697862-caesars-entertainment-corporation-all-bets-are-off?source=google_news

No comments:

Post a Comment