Remember Steve Wynn [being investigated for Foreign Corrupt Practices Act violations and much else] blabbing on about how inexperienced Massachusetts was?

Remembers all the attacks and pretense about CAESARS?

Every body got in bed with Gary Loveman , the genius who revolutionized GAMBLING ADDICTION, ignoring the MASSIVE DEBT.

At what point do the political hacks protect constituents?

[Suffolk Downs was prepared to 'partner' with the insolvent CAESARS, Mayor Menino signed a HOST COMMUNITY AGREEMENT with these clowns and the Casino KoolAid consumers embraced without question this insolvency. Do you think you needed to be a financial specialist to recognize that $23 BILLION in DEBT is a disaster waiting to happen?]

Caesars: All Earnings To Interest Payments

Nov 22 2013

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Caesars' Debt Burden Mitigates Possibility of Equity Returns At Least through 2020 Recommendation: Strong Sell Our research indicates that Caesars (CZR) is a poor equity investment choice that offers low expected return to equity investors with high speculative risk. The basis for our recommendation is that the company has a significant debt burden creating interest expense that is absorbing all operating cash production. The company has approximately $20 billion in outstanding debt principal, with significant balloon payments of $17 billion due through 2020.

Caesars' is the 6th largest gambling entertainment company in the world with 6.5% global market share, and its 68,000 employees generate approximately $8 billion in revenues. The company produces an impressive cash flow from operations of nearly $1.8 billion annually, but this is quickly spent on interest averaging around 10%. I will outline the major risks facing the company below. For income statement, balance sheet, and Excel model, please visit the original post.

Before we go too far, we should take a look at the current financial statements - we have hidden superfluous rows that are not meaningful for the analysis, these should not have a material impact on our assumptions or report. The balance sheet for Caesars as of Q3 2013 needs to be adjusted for two significant reasons. First, the company refinanced $4 billion in debt that was maturing in 2015 by issuing $2 billion in new debt and purchasing the remainder using cash. This likely wiped all nearly all the company's cash.

However, it should be noted at this point the company showed only $1.7 billion in cash - right now debt for Caesars is trading well below book value because it is rated below investment grade.

Fortunately, Caesars reported similar debt repurchases YTD, so we can assume this debt was repurchased at a similar 15% - 25% discount, which will be reflected as a positive gain on the next published income statement (which will be their annual filing in December).

These actions should all but wipe out the debt balance and reduces long-term debt by about $2 billion. Second, Caesars sold their online gaming business to Caesars Acquisition Company (CACQ) for $1.18 billion. From a balance sheet perspective this will increase cash by that amount, with the impacts flowing through the income statement in coming years. I will discuss this more in a bit, as the online gaming business was CZR's best chance for growth.

CZR - An LBO Case Study

A quick overview of how an LBO works - a private equity firm raises debt to buyout the equity in the company. The private equity firm now owns the target company with little initial investment, though possibly is subject to recourse if the debt goes belly up. The idea is the private equity firm believes they can sell of parts of the company to repay the debt with a remaining profit above the debt raised and interest paid, or they can increase operational profits so the cash flow produced is above the debt service needed with the remainder going to the PE firm. In either case the PE firm has little initial exposure, so any positive return is massive.

In the case of CZR, two PE firms - TPG and Apollo - took the company private by raising approximately $30 billion in debt. Much of this debt was issued at 3 - 4% (such as the $4 billion in CMBS that was due to retire in 2013, extended to 2014, option to extend to 2015, but refinanced with $2 billion retired and $2 billion due in 2020/2021). However, much of the debt was shorter term issues, and as these came up for refinancing, investors demanded rates closer to 10% due to the high leverage of the company and the industry's prospects.

As reflected in the income statement above, the company is paying about $1.7 billion on $23 billion of debt. Fortunately for CZR debt holders, the company has a profitable operating business generating nice margins. This provides enough cash to service interest on the debt. However, the forthcoming principal payments are unmanageable. I've consolidated the upcoming principal payments by year under current portion of debt due for that year: (refer to original article on woodfieldcg.com)

Now, to step back to 10,000 feet. After adjusting for the debt repurchase and the sale of the online gaming business, the company should be sitting on about $1.2 billion in cash plus restricted cash in escrow for debt repayment of about $500 million, so about $1.7 billion total. The company generates about $1.7 billion in EBITDA but pays about $2 billion in interest. Obviously this will eat away quickly at the company's cash balance unless they can replenish through operating growth, increasing future EBITDA, or selling additional assets, eroding future EBITDA.

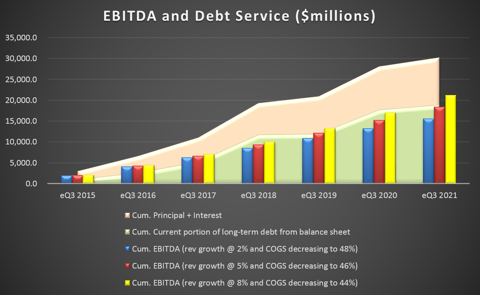

But the real 800 pound gorilla is the debt principal payments. Holding revenues and margins constant, the company will have to use approximately $300 million of held cash to cover interest expense. Then they will need to use the remaining billion or so for principal, sucking the company dry of operating funds. If somehow they make it through 2015, they need to raise another $1.6 billion for principal + $1.9 billion for interest expenses in 2016 (roughly), or $3.5 billion raised in cash from operations in 2015/2016. Then in 2017 and 2018, $2.6 billion in principal and $6.5 billion in principal + $3.5 billion in interest expense, for $12.5 billion over those two years. From 2015 thru 2018, Caesars must earn or raise $11.5 billion in principal + $8 billion in interest for $19.5 billion total, on EBITDA of present assets of approximately $8 billion. The remaining $11.5 billion must come from growth in earnings, selling assets, or kicking the debt can down the road. But as can be clearly be seen, the company has ample funds to service its debt at 10% (a nice return) in perpetuity, as long as principal never has to be repaid. Below is a chart I have summarizing the debt service due against some EBITDA forecasts:

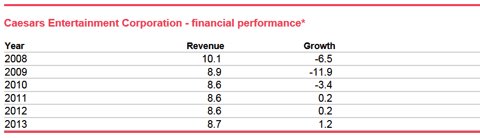

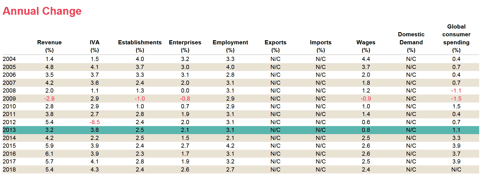

Unfortunately for Caesars, gambling is a mature business with growth near GDP, and with medium volatility. Caesars has underperformed industry peers, particularly in the industry's recent best year, 2008. Below are tables from IBIS World of Caesars' revenue growth since 2008 and past and future estimates for the international gaming industry. Compare the forecasts for international gaming along with Caesars' relative performance to the chart above which is assume in the worst case scenario 2% growth revenue (unlikely attainable for Caesars). The only way equity holders come out ahead with value and positive return is with option 1, but we think this is nearly impossible and highly speculative.

(click to enlarge)

Source: IBIS World, November 20, 2013.

(click to enlarge)

Source: IBIS World, November 20, 2013

To wrap this up, I think it is highly unlikely Caesars will produce the organic growth necessary to service its debt, so the company will need to rely on options 2 or 3, divestiture or raising debt, or both. Buyers of assets know the companies dire position and will not be ponying up premiums. Debt issuers will be demanding the 10% interest they currently charge. In one upside case for debt holders who enjoy the 10% interest at junk ratings, the company can retain current assets and grow EBITDA at ~1% per annum, refinancing principal as it comes along.

In this case, it is purely a company for the debt holders, and the equity holders will be left with nothing over time, at least at today's present value. If the company cannot refinance, there will be forced liquidations of assets, possibly through bankruptcy, and eroding any possible growth in the future. The PE firms, TPG and Apollo, realize this, and have started to divest growth assets, such as the online gaming. As long as opportunistic assets can be divested without breaking debt covenants, expect this to be the game plan forward for extracting value out of CZR into new entities, such as CACQ, that you may or may not have access to (i.e. new PE funds).

No comments:

Post a Comment