DETROIT BANKRUPTCY OBJECTIONS RAISE POSSIBLE BANK CRIMES RELATED TO POC DEBT AND CASINO TAX DEAL; HUNDREDS PROTEST BANKS IN DOWNTOWN DETROIT

City retiree, pension funds object to “Forbearance Agreement”

Hearing set for Tues. Sept. 4 at 10 a.m. before Judge Rhodes

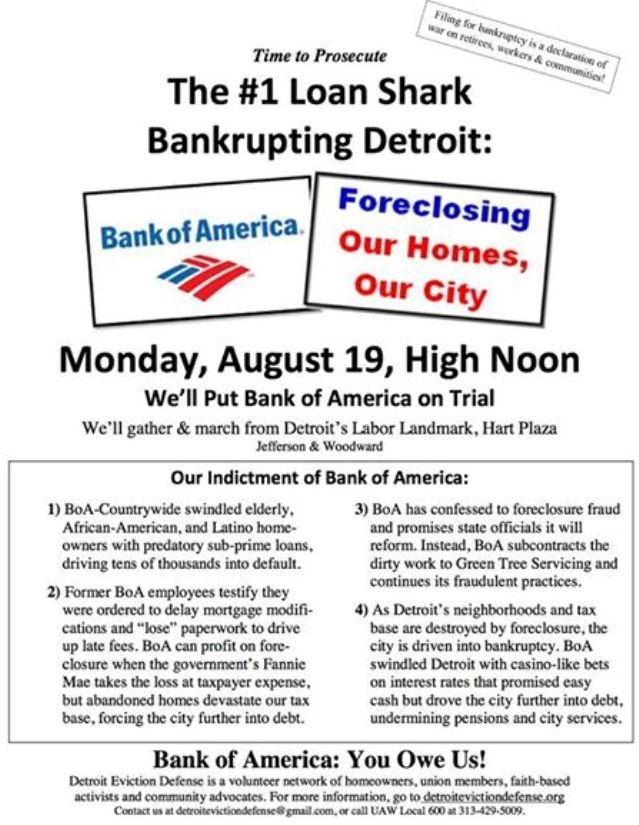

Hundreds protest banks’ role in devastation of Detroit Aug. 19

By Diane Bukowski

August 20, 2013

(Story on bankruptcy eligibility objections will be forthcoming shortly.)

Hundreds protested outside Bank of America offices in downtown Detroit Aug. 19, 2013.. Protest included street theater: here “Judge” Jerome Goldberg convicts “Bankula” of crimes, sentences him to 150 years in prison.

DETROIT – Eye-opening objections filed in the City of Detroit’s bankruptcy case Aug. 16 allege that Detroit creditors UBS AG, SBS Financial Services, and Bank of America may have been guilty of criminal activity related to the $1.5 Pension Obligation Certificates (POC) loans to the city in 2005 and 2006, and related interest swaps.

They also say those banks are continuing to rob the city through a “Forbearance Agreement” reached July 15, 2013, which is subject to approval by U.S. Bankruptcy Judge Steven Rhodes. Detroit Emergency Manager Kevyn Orr earlier boasted that this agreement will release the city’s casino tax revenue of $11 million a year, held as collateral to pay off the POC debt.

“Detroit has been working its way to a level of insolvency for decades,” Detroit Emergency Manager Kevyn Orr said while announcing the bankruptcy filing July 18. “Part of the reason we’re here is that in 2005 and 2006, Detroit borrowed $1.5 billion to provide a solution for pension obligations, then hedged those with swap agreements for which we paid hundreds of millions.

We went into default on those agreements in 2009 so we doubled down and pledged the city’s casino revenues to support the agreements. For some time, Detroit has simply not been on a sustainable footing.”

Orr claims that debt is part of an outstanding $3 billion the city owes its pension systems, although they are not a party to the transactions involved and objected strenuously to the issuance of the POC bonds. Then City Councilwoman Sharon McPhail termed POC’s “one of the seven deadly sins of municipal finance.”

City retiree David Sole, the city’s pension funds, and other creditors including insurer Syncora, Inc., have filed objections to “the Forbearance Agreement,” which would allow the city to pay the banks involved 75 cents on the dollar on swaps related to the debt, in return for the “release” of $11 million a year in casino tax revenues held hostage to ensure the city’s payments on the POC debt.

A hearing on the objections is set for Tuesday, Sept. 4, 2013 in front of U.S. Bankruptcy Judge Steven Rhodes.

The objections by Sole and the pension fund allege that the agreement will cost the city hundreds of millions more than what the discount saves. Despite the bankruptcy’s stay on debts, the city has continued to pay UBS and its partners on the swaps, Orr earlier admitted during a press conference July 19.

“The Interest Rate Swaps on Pension Obligation Certificates entered into by the City of Detroit with UBS and SBS/Bank of America constitute a drain of hundreds of millions of dollars to the banks from the City’s budget with nothing positive for the City in return,” Attorney Jerome Goldberg writes in the Sole objection.

“Basically, the Interest Rate Swaps obligate the City of Detroit to pay UBS and Bank of America 6.323% interest on $800 million in bonds, when the actual rate on the bonds is only 0.6056%. The banks, who on information and belief presented this ‘deal’ as a beneficial one for the City, pocket the difference between the interest paid to them and the actual interest rate on the bonds, as clear profit, amounting to at least $45.1 million according to Emergency Manager Kevyn Orr’s May 12, 2013 Financial and Operating Report.”

The objection notes that UBS and Bank of America have both been charged with fraudulent practices related to municipal bonds, and are implicated in the global LIBOR and ISDAfix scandals. The two banks and many others allegedly rigged interest rates set by LIBOR (the London Interbank-Offered Rate panel) to benefit themselves and their clients. They have also been charged with rigging the ISDAfix, which affects calculations of termination fees associated with interest rate swaps.

Three UBS municipal bond executives were recently sent to prison, along with two others in LIBOR-related activities. A former Bank of America executive has also been indicated for municipal bond fraud.

UBS. Bank of America, others devastated Detroit with foreclosures, said protesters outside BOA Aug. 19, 2013.

“In addition, both Bank of America and UBS, as documented in countless lawsuits and consent judgments with the federal government and state governments including Michigan, and UBS were major subprime lenders and participants in the illicit mortgage activity that precipitated a virtual financial collapse in 2008, and that especially implicated cities with large African-American populations like Detroit,” Goldberg writes.

“The financial crisis that precipitated this Chapter 9 bankruptcy filing was in large part a result of the effects of predatory lending by the banks against the residents of Detroit, which resulted in tens of thousands of foreclosures in the city, a massive population decline and a precipitous decline in property values.”

The objection attaches a copy of a lawsuit filed by the Detroit Police and Fire Retirement System against financial institutions including UBS, “for losses suffered as a result of being sold allegedly fraudulent mortgage securities.”

Both Sole and the city’s pension funds, represented by Attorneys Robert Gordon and Shannon Deeby of Clark Hill, allege that the Forbearance Agreement includes no information necessary to assess its alleged benefits to the City.

(L to r) Detroit CFO Sean Werdlow, SBS rep Bill Doherty, Joe O’Keefe of Fitch Ratings, Stephen Murphy of Standard and Poors, and Deputy Mayor Anthony Adams press for $1.5 POC loan from UBS, SBS at City Council table Jan. 31, 2005./Photo by Diane Bukowski

“. . .the Assumption Motion is devoid of material information necessary to assess the benefits of the Forbearance Agreement,” write Gordon and Deeby.

They say the motion fails to explain “(i) whether a valid termination event exists . . . .that necessitates the Forbearance Agreement in the first instance; (ii) whether the Swap Counterparties’ asserted prepetition liens validly extend to Casino Revenue generated postpetition; (iii) what claims, obscurely alluded to in paragraph 47 of the Assumption Motion, may exist to challenge the validity of the Swap

Contracts and liens, which claims are being waived; and (iv) by what means the City intends to obtain funds likely in excess of $200 million in the next roughly 2-6 months to effectuate an Optional Termination.”

“Summer of Solidarity,” which is visting 13 cities across the U.S. to combine forces, participated in Bank of America protest Aug. 19, 2013.

Paragraph 47 of the city’s proposed Forbearance Agreement says in part, “Further, while the City has examined whether there are viable actions to challenge the Swap Contracts or the City’s pledge of the Casino Revenue to secure its obligations to the Swap Counterparties, litigation would be protracted, expensive and, in terms of success, uncertain. The Swap Contracts and related documents are exceedingly complex, as is any determination of the amounts owing and the rights of the parties thereunder. While certain creditors have informed the City of their views on these arrangements, regardless of the merits of these positions, the issues are extremely complicated and, accordingly, subject to a high degree of uncertainty.”

An obscure sentence in Orr’s “Proposal to Creditors,” issued June 14, 2013 during a meeting at the Detroit-Wayne County Airport, also says, ‘The City has identified certain issues related to the validity and/or enforceability of the COPS that may warrant further investigation.”

VOD editor Diane Bukowski (second from left) questioned Orr after he presented Proposal to Creditors at airport June 14, 2013. WWJ’s Vickie Thomas is at left.

Asked by VOD during a press conference after the meeting whether he would investigate criminal actions by the banks related to the POC’s, Orr said he would instead investigate the pension funds.

The next week, he announced such an investigation.

“Party of Interest Sole believes that if the City of Detroit’s Emergency Manager exercised his statutory mandate under PA 436, Section 16, to conduct a criminal investigation of activities of the swap counterparties . . .the City of Detroit may have been in a much better position to negotiate with the banks to resolve the interest rate swaps which have cost the City tens of millions of dollars in desperately needed revenues and which will cost the City hundreds of millions more, even under the forbearance agreement which the City seeks to implement,” writes Goldberg.

He suggests that Orr should invite the Securities and Exchange Commission (SEC) to investigate the City’s bonds with UBS and Bank of America, noting that UBS already entered into an SEC judgment “relative to illicit activity involving the City of Detroit Water Department bonds.”

“Emergency Manager Orr could also invite the SEC to intervene in this bankruptcy proceeding pursuant to Section 1109(a) of the Bankruptcy Code which is incorporated into Section 901. The SEC could bring the expertise and information gained by their extensive examination of illicit activity in the municipal bond markets into this Chapter 9 proceeding. Interested Party Sole and several other City of Detroit retirees have taken the initiative to enlist the support of United States Senator Carl Levin in prompting SEC involvement in this case,” writes Attorney Goldberg.

Attached to the motion is a letter sent by retirees to Levin, who headed a Senate Judiciary Panel in 2009 which reported massive fraudulent activity by the global banks, resulting in the economic collapse of 2008.

Syncora, Inc., which insured payment of the swaps, has also objected to the motion, claiming it was a party to the swap agreements but was not involved in negotiating the Forbearance Agreement. Syncora may have reached a settlement on its objections, according to news reports.

Former Detroit Corporation Counsel and mayoral candidate Krystal Crittendon distributed objections to bankruptcy for protesters to submit Aug. 19. The objections insist that lawsuits against constitutionality of the Emergency Manager law, PA 436, be heard prior to continue of bankruptcy proceedings.

Related documents:

Objection to forebearance DSole JG (exhibits follow below)

FA exhibit 1 Affidavit of David Sole

FA exhibit 2 to 4 UBS article; Senate report on bank crisis; PDD report on foreclosures

FA exhibit 5 DPFRS lawsuit re UBS

FA exhibit C POC debt docs

FA exhibit G LIBOR rate calculations; articles on UBS, LIBOR ISDAfix

FA exhibit L Articles on UBS, BOA executive jailings; SEC judgment against UBS in DWSD bonds

PFRS – City of Detroit – Objection to Forbearance Agreement – FILED (Pension funds objection)

Bankruptcy objection letter 2 (This is blank bankruptcy objection letter distributed by Krystal Crittendon Aug. 19. She advised that individuals should still file after eligibility objection cut-off date of Aug. 19 because letter alleges not enough time was allowed to file objections. According to Attorney John Philo, the judge in the Stockton bankruptcy case allowed nine months.)

Story is also forthcoming on Detroiters Resisting Emergency Management Forum held Aug 17, 2012. Above is a video showing a snippet of the conference: the people’s fighter Monica Lewis-Patrick speaking.

ONNAMOVE DETROITERS!

FOR MORE INFORMATION, CONTACT THE STOP THE THEFT OF OUR PENSIONS COMMITTEE (STOP) AT 313-680-5508; Moratorium Now at www.moratorium-mi.org; Detroiters Resisting Emergency Management at (313) 782-DREM (3736); Detroit Eviction Defense at http://www.detroitevictiondefense.com/, and numerous other groups.

- See more at: http://voiceofdetroit.net/2013/08/20/detroit-bankruptcy-objections-raise-possible-bank-crimes-related-to-poc-debt-and-casino-tax-deal-hundreds-protest-banks-in-downtown-detroit/#sthash.6xSXlAOX.dpuf

No comments:

Post a Comment